Every year, the festive season arrives with the same blend of joy, chaos, and quiet panic. And nothing sums that up better than The Twelve Days of Christmas — a song that starts innocently with a partridge and very quickly becomes a shopping list that would make even Santa sweat.

But here’s the twist: people have actually calculated the cost of buying every one of those gifts. And the numbers, especially in 2026, tell a surprisingly serious story about inflation, rising costs, and what UK SMEs are really up against.

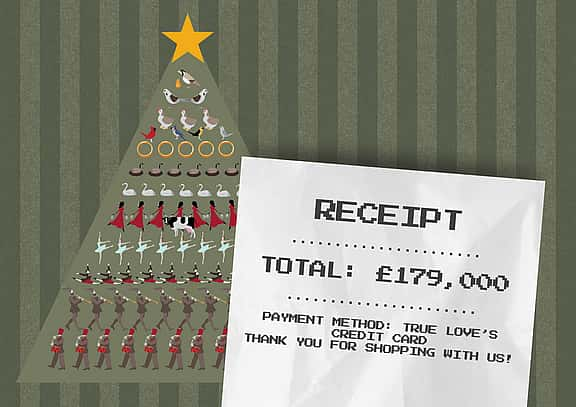

A quick refresher: How much does “True Love” really spend?

The Christmas Price Index — created by PNC Wealth Management in the US — tracks the cost of buying everything mentioned in the song. It’s tongue-in-cheek, but it’s grounded in real market prices: birds, musicians, performers, and even gold rings.

In 2025, the cost of buying one set of the 12 gifts was US $51,476.

Buying all the gifts as repeated in the song (that’s 364 individual items) shot up to US $218,543 — up around 4.5% on the previous year.

With inflation still sticky in many categories in 2026, it’s realistic to assume a further 3–5% increase this year. Using a middle-of-the-road 4% estimate gives us a working figure for 2026:

Estimated 2026 cost of all 364 gifts: ~US $227,284

(Or roughly £179,000 using late-2025/early-2026 exchange averages.)

Again, this is an illustrative estimate, not a certified quote for 12 drummers and a flock of swans.

But it’s enough to make the point: Christmas is getting more expensive… fast.

Why this matters in the UK: Inflation is still biting

While US figures give us the model, the UK context is where things really hit home.

-

The UK’s official inflation rate (CPI) has hovered around 3–4%, depending on the category.

-

Energy, labour, and food costs remain elevated, even as headline inflation cools.

-

SMEs in particular feel this squeeze harder than large organisations with deeper pockets.

So if Christmas costs are rising each year — even in a fictional index — the same applies to the real costs UK businesses face every single day.

And this is where the festive fun becomes a serious warning sign.

What the “True Cost of Christmas” says about UK SMEs in 2026

Let’s translate the impact.

1. Labour is more expensive — and SMEs feel it first.

Maids-a-Milking, Ladies Dancing, Lords-a-Leaping… it all adds up.

In real life, labour-intensive sectors — hospitality, retail, logistics — have seen some of the biggest cost increases. SMEs often can’t match big-company wages, so they lose staff or absorb the cost.

2. Equipment isn’t getting cheaper either.

From forklifts to laptops, coffee machines to production kit, the cost of upgrading or replacing equipment has jumped. The same supply-chain issues that inflate the price of a goose or a gold ring hit SMEs across the board.

3. Cashflow is under more strain than ever.

Festive costs remind us that when every input rises, the pressure collects in one place: cashflow. Most SMEs don’t have the luxury of large reserves, meaning a single spike , energy, repairs, staffing can derail a whole quarter.

4. Consumers are spending more cautiously.

Higher costs for households = slower sales for SMEs. If a family feels the pinch buying Christmas dinner, they’ll feel it buying services and goods from small businesses too.

So Where Does Leasing Fit In?

Here’s the big lesson from the song:

Buying everything outright is unrealistic. Spreading the cost makes the impossible feel achievable.

Sound familiar?

That’s exactly why more UK SMEs are turning to leasing in 2026:

-

predictable monthly payments

-

access to the latest equipment

-

easier budgeting

-

no massive upfront capital hit

-

flexibility to scale

Whether it’s production machinery, IT infrastructure, security systems or commercial kitchen equipment, leasing helps SMEs stay competitive without taking on the kind of six-figure pressure our poor true love faces in the song.