Get started now

Invoice pre-financing allows you to make your own cashflow decisions and gives you a host of other benefits.

How do you decide?

Is invoice finance right for you? Take our test and find out.

VIDEO: Discover how grenke invoice finance can unlock immediate cash flow and empower your business to thrive

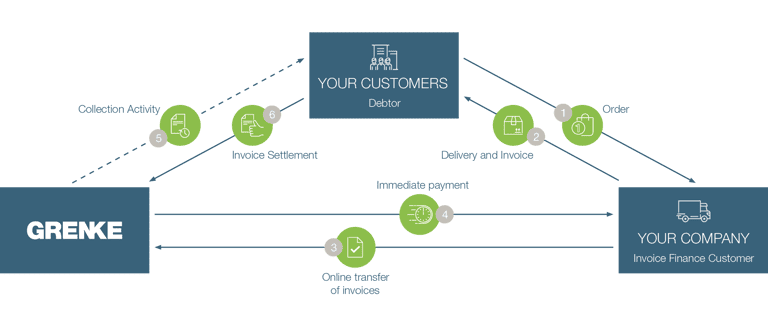

INFOGRAPHIC: A step-by-step guide

Compare our products

Invoice finance Choice gives you liquidity when you need it. What can our other invoice finance products do for you?

Invoice Finance Classic

Invoice FInance Flex

Invoice Finance Choice

Assumption of complete accounts receivable management

Pre-financing for specific invoices

Pre-financing of selected accounts receivable

Credit checks for entire customer bases

Credit checks for selected accounts receivable

Our team’s expertise

At Grenke invoice finance, our dedicated team combines years of finance experience with industry expertise to support your business’s growth. Our account managers and credit specialists offer personalised, tailored solutions and exceptional service to ensure you have the financial flexibility to thrive. Meet the team that drives our success.

FAQs | Choice

What is Choice, and how does it work?

Choice invoice finance from Grenke is a flexible invoice finance solution that allows you to selectively choose which invoices to factor. Unlike traditional factoring, where all invoices might be included, Choice invoice finance gives you control over individual invoices or batches. You submit the invoices you wish to factor, receive an advance on those invoices, and then the remaining balance, minus the fee, is paid to you once your customers settle the invoices.

Are there any requirements or limitations for the invoices I choose to factor?

With Choice invoice finance, grenke does not impose strict requirements or limitations on the invoices you select. You can factor invoices of various amounts and from different customers based on your needs. However, invoices must meet our general criteria, such as being issued to creditworthy customers and not being overdue. Our team will work with you to ensure that the invoices you choose are suitable for invoice finance.

How is the fee structure determined for Choice invoice finance?

The fee structure for Choice invoice finance is based on a percentage of the invoice value and may vary depending on factors such as the volume of invoices factored and the credit risk associated with the invoices. We provide a clear and transparent fee breakdown before you start using the service. This allows you to understand the costs associated with financing each invoice and plan your finances accordingly.