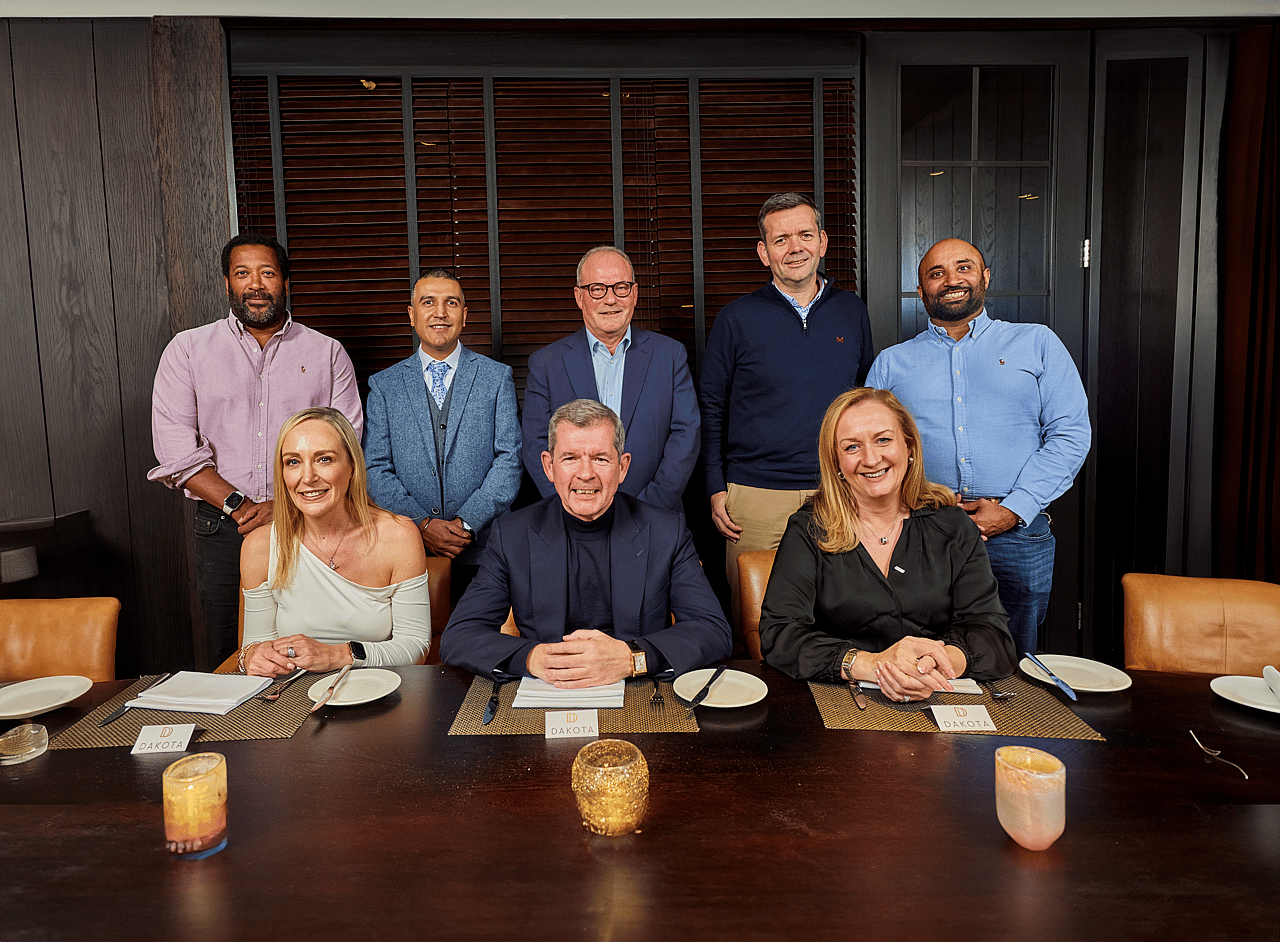

PARTICIPANTS

David Horton – Managing Director of Sales, grenke Leasing – Discussion Chairman

Jit Nijjar – National Sales Manager, grenke Leasing – Host

Bernard Henry – Managing Director – Clarity Office Solutions (Pennine) Limited

Sylvie Giangolini – Managing Director – Hako Machines Limited

Michelle White – Managed Print Director – ACS Managed Print Limited

Andrew Bennell – Sales Director – AFP Group Limited

Justin English – Chairman – XBM Limited

Bill Sohal – Director – Z1 Telecom Limited

grenke Leasing commissioned a Report, Lease of Life, to gain a greater understanding of how SMEs approach their critical financial decisions. The Report explores the impact that alternative finance, in particular Leasing, has on SMEs and on the wider UK economy. We spoke to over 600 SME businesses around the UK about their attitudes towards Leasing and we found that for them it is the eighth most important form of financing. Therefore, we set out to identify the barriers, and in turn, how we can better profile the benefits.

Following the launch of the Report, grenke Leasing held its first Round Table discussion inviting dealers across a number of different industry sectors to share their thoughts on these key themes. grenke’s Managing Director of Sales, David Horton, and National Sales Manager, Jit Nijjar, were joined by directors from Clarity Office Solutions (Pennine) Limited, Hako Machines Limited, ACS Managed Print, AFP Group Limited, XBM Limited and Z1 Telecom Limited.

Let’s join the conversation.

Do resellers’ end customers understand the benefits of Leasing as a beneficial way to finance their businesses? And, do Leasing

companies provide enough information and education for resellers to share with them to highlight the benefits?

David Horton, Managing Director of Sales, grenke Leasing, opened the discussion by setting the scene. “We commissioned our Report because we wanted to better understand the position of grenke Leasing’s products from our mutual customers’ perspective. By mutual customers, I mean those who use the equipment provided by the Equipment Resellers we work with. We conducted an independent survey, using external consultants, because it was important that we avoid aligning ourselves with anecdotal information. And, it was a revelation because it was easy to assume that most business leaders have a reasonable working knowledge of Leasing or at least how to access it. However, our Report showed that they don’t and very surprisingly only 4% of the businesses we surveyed had actually used it to acquire their business equipment. Therefore, we’re asking the question, “What do we need to do to support our resellers who are our immediate customers, to help their customers?”

Sylvie Giangolini, Hako Machines Limited: I started to really understand the benefits of Leasing at my previous company, which supplied laundry equipment. While I was there, we did a combination of lease and rental arrangements depending on the nature of the business we were supplying because it made commercial sense for us. So, when I joined Hako, and they weren’t offering it, I implemented it. As well as helping our customers, it’s helped our business to grow.

Justin English, XBM Limited: I worked for a couple of Leasing companies before I started XBM and initially I didn’t appreciate that there can be tax benefits to it. But then I realised that for the smaller transactions it was a bit of a red herring and it only becomes a valid argument when it‘s used for transactions over around £500,000.

David Horton: Yes, I agree. So, let’s give this type of Leasing its more accurate title - Small Ticket Sales Aid Leasing - which is generally for transactions between £8,000 and £50,000. In reality, at grenke we write deals far in excess of this too. It’s all very much seen as a sales aid regardless of the size of the deal.

Bill Sohal, Z1 Telecom: I have some customers who may take out a lease two or three times, and who may then change their minds and decide to buy equipment if they have the cash available. But, Leasing particularly helps finance equipment where there are likely to be regular upgrades.

Michelle White, ACS Managed Print: When I first met David and grenke we had absolutely zero experience of Leasing. Since then, our business has evolved especially in IT, furniture, print and managed print. Leasing has particularly played a key role in developing our managed print (MPS) business. We always lead with Leasing on printers as this provides our customers with cost predictability and preserves their capital for other essential investments. We offer Leasing as standard, but if someone wants to know how much it would cost to buy the equipment outright, we’d discuss that too. And, as our business has diversified in other areas, we offer these assets on a lease too.

Andrew Bennell, AFP Group Limited: I nearly fell off my chair when David said that only 4% of the people grenke surveyed used Leasing. I can’t speak for the rest of you here, but I think over 90% of our customers have a lease. When we started our business we didn’t have a consumer credit licence so we did Leasing through a contact of ours. This was around 15 or 16 years ago and we learned from them that you could lease every device you’ve got in the office and that you could also collect the maintenance as part of the package you were offering.

Bernard Henry, Clarity Office Solutions (Pennine) Limited: When I started back in 1989, to be able to offer somebody the opportunity to spread the cost and not have to pay up front, was great.

Andrew Bennell, AFP Group: Now there are other procedures that we have to follow too like KYC, Persons of Significant Control and establishing who the owners of the business that you’re leasing the equipment to are.

Justin English: Can I just ask the question - how do you get into those different market places? I think the penetration is only around 12%, so how can we improve it? My view is that salespeople need to present the benefits of sales aid leasing in the most seamless way possible for us dealers to promote.

David Horton: That’s interesting. What we also find is that when you approach businesses they’ll happily sign a contract for a photocopier, but if you present them with a lease contract for a different type of asset – let’s say air conditioning or office furniture – they say they’d rather pay cash. So, we could assume they are pre-conditioned that when it’s a photocopier it’s ok to lease it, but perhaps not other asset types.

Bernard Henry: In my eyes it’s all about training and education. So, what I think grenke should do, is start a training arm that goes into the dealership and trains them how to powerfully deliver a passionate message about their products and how these products can best be sold. And these days, using technology, it’s a quicker process. Covid-19 forced a lot of contract paperwork to be scanned. So at Clarity we’ll scan the docs, including the terms and conditions, and email them to the customer so there is total transparency from the outset. That’s become routine for us and it works well.

Jit Nijjar, National Sales Manager, grenke Leasing: From our point of view, as a Leasing company, it then also becomes all about risk. Or, in other words, the combination of credit, the customer and the warranty provided by the manufacturer. That’s the overriding principle of what we do. And, hence, there is work that we have to do to ensure that when we lend money to a customer, we can guarantee that we’ll get all of it back. So it’s also important that the customer understands how the lease transaction works and its benefits, along with who grenke is and the role that we play.

David Horton: Going back to Bernard’s suggestion of grenke training the resellers, that’s the real pearl of wisdom. It makes sense to provide detailed training to the resellers setting everything out. From the financial product we offer, equipment protection which is the grenke term for insurance, the document fee, the contents of the contract in general and how we calculate the rental payments. Plus, the benefits of Leasing over buying an asset.

Bernard Henry: Yes, definitely.

Michelle White: I would agree. Leasing is a great way to help businesses access the latest technology without all the upfront costs so let’s educate people.

David Horton: It would also be very helpful to raise the grenke brand and what we do because while the reseller knows who we are, the customer doesn’t know who grenke is.

Andy Bennell: Ultimately, you are helping us facilitate a transaction. It’s about being transparent with the customer and explaining how Leasing can help as well as what’s in the contract.

David Horton: That ties in with what Bernard said about education because over the years I’ve been in this business it’s clear that some reseller salespeople perhaps don’t have that training. So, it might not be so much about training the customer, it’s more about training the reseller and their sales people more thoroughly.

Sylvie Giangolini: My team is really agile in their commercial thinking and now they probably don’t even think about it. When they visit a customer they know that they could be leaving with either a lease or a purchase, depending on what they’re selling and who they’re selling to. If it’s a lease, my document is signed before I even order the product from Germany, which is where our production is based. I can’t risk an asset coming into the UK without having a home to go to.

David Horton: That’s the perfect scenario. You’ve got the clean situation of the customer signing and committing to the financials and the contract. You, the reseller, have discussed it, the customer has assessed it and they like it.

Justin English: A question that is linked to the whole discussion. We briefly touched on the use of technology earlier, but what percentage of your business is done on DocuSign or eSign?

David Horton: Well, electronically, it’s almost 100%.

Michelle White: We still do a lot of wet signs.

Justin English: Covid changed us and 100% of signatures were electronic. Now I’d say we’re about 90:10. So, 90% of what we do is all on DocuSign and 10% is wet signatures. But, internally, we have a lease support desk. Basically, we’ve got a team of three people who process all the leases that our salespeople produce, so all the leases are sent there. They do the underwriting and then they send it to the Leasing company. When the contract is returned to the customer, it’s sent out from our lease support desk.

David Horton: That’s very interesting because that reflects our experience. Where we’ve identified that a reseller has a dedicated contract processing desk or dedicated individual, the quality of the contract paperwork we receive is significantly more accurate and consequently paid out quicker

Jit Nijjar: There are certain procedures that we have to work with – it’s a legal requirement - but grenke’s USP is also that we don’t just say “no” if a deal doesn’t initially pass. We’ll use the word “decline” and give a reason why because at the end of the day, we’re in the business of approving deals proposals. Ultimately, we want to say “yes”!

David Horton: I think there’s one thing that’s been loud and clear tonight and it’s the need for education and how we can better support your teams. When I was being trained, we ‘shadowed’ someone for about three months and that was how I learned about the business. . Unfortunately, nowadays, the industry doesn’t appear to have the time and resource to invest in people like we used to. Although it is changing a little bit with the apprenticeship scheme introduced by the Government which is encouraging businesses. And if we look at Bernard’s business. He’s brought his sons into the business training them from the ground up. Where businesses train their people, generally they become very good at what they do. At Grenke, we’ve seen the opposite of this. For example, when you have salespeople who’ve been trained to sell by being the cheapest, the result is very often that service levels suffer. Then you end up with customer problems. The knock on effect of this is felt by organisations like grenke Leasing.

Sylvie Giangolini: That’s happened with the forklift truck industry. People were happy to reduce their margins by making them up over the lifetime of an agreement through damage charges etc. But then everyone got savvy to that and now everyone is doing deals on maintenance. Because everyone is on that race to the bottom, the question then becomes where does the bottom actually sit? Is it when you start losing money?

David Horton: I hope Bernard doesn’t mind me picking him out again. I think the takeaway from this discussion is not just that only 4% of the SME businesses we surveyed use Leasing, but that there is a real need for education amongst the reseller community. To share how they can promote the range of benefits of Leasing to customers and their businesses. Also, to address the other hurdles which resellers may come up against – for example, what’s equipment protection, what are the documentation fees for and above all who is grenke and what we do! So, we are going to follow up on the education piece because ultimately it will help both parties – our resellers and grenke - to write better business and more of it and ultimately our Customers.

grenke Leasing provides the financial means and the flexibility which enables businesses to access the equipment at the time they need it and conserve cash. And by opting to lease over asset ownership, businesses have the flexibility to upgrade when it best works for them.

Report: how leasing can transform your productivity and profitability

The UK economy has been through a difficult period. High inflation, a cost-of-living crisis and a staggered bounce back from Covid-19 have all played a part in slowing economic recovery. But as we ...

The shift to a subscription-based society

When was the last time you signed up to a subscription? Was it for a streaming service? A ready supply of groceries? Or was it a coffee gift box, with new flavours every month? From entertainment streaming to personal grooming subscription models have firmly established themselves ...