All-inclusive invoice finance

Transferring receivables offers many benefits. With Factoring Classic, you can enjoy them all.

Is this what you need?

Not sure whether invoice finance is right for you? Find out with our invoice finance test.

VIDEO: Discover how grenke invoice finance can unlock immediate cash flow and empower your business to thrive

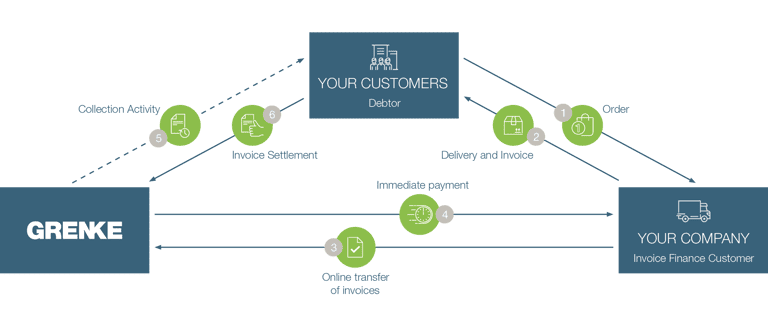

INFOGRAPHIC: A step-by-step guide

Compare our products

Invoice Finance Classic

Invoice Finance Flex

Invoice Finance Choice

Assumption of complete accounts receivable management

Pre-financing for specific invoices

Pre-financing of selected accounts receivable

Credit checks for entire customer bases

Credit checks for selected accounts receivable

Our team’s expertise

At Grenke invoice finance, our dedicated team combines years of finance experience with industry expertise to support your business’s growth. Our account managers and credit specialists offer personalised, tailored solutions and exceptional service to ensure you have the financial flexibility to thrive. Meet the team that drives our success.

FAQs | Classic

What is Classic, and how does it benefit my business?

Classic invoice finance from Grenke allows you to receive immediate cash advances against your outstanding invoices. This service helps improve your cash flow, giving you the liquidity needed to cover expenses, invest in growth, or manage day-to-day operations without waiting for customers to pay. By converting your invoices into cash, you can ensure steady cash flow and reduce the risk of late payments impacting your business.

Will my customers know I’m using a invoice finance service?

Yes, with Classic, your customers will be informed that their invoices are being managed by Grenke. However, we handle all communications professionally and maintain positive relationships with your customers. Our goal is to ensure that the invoice finance process is seamless and beneficial for both you and your clients.

Is there a minimum or maximum invoice amount for grenke Classic?

Classic is designed to be flexible, accommodating a wide range of invoice amounts. While we don't impose strict minimums, we typically work with businesses that have a consistent invoicing volume. There is also no set maximum limit, allowing you to factor as many invoices as needed to maintain your cash flow. Our services are tailored to scale with your business, whether you have a few large invoices or many smaller ones.